ANALYSIS: Exchange ESTR open interest spikes as products mature

The three exchanges that offer euro short term rate (ESTR) futures hit on Tuesday record open interest in the futures based on the European risk-free rate, as open positions on the three markets have continued to tick up over the past month.

CME Group, Eurex and Intercontinental Exchange (ICE) hit open interest records on Tuesday as a combination of rates positioning and liquidity programs continued to drive activity.

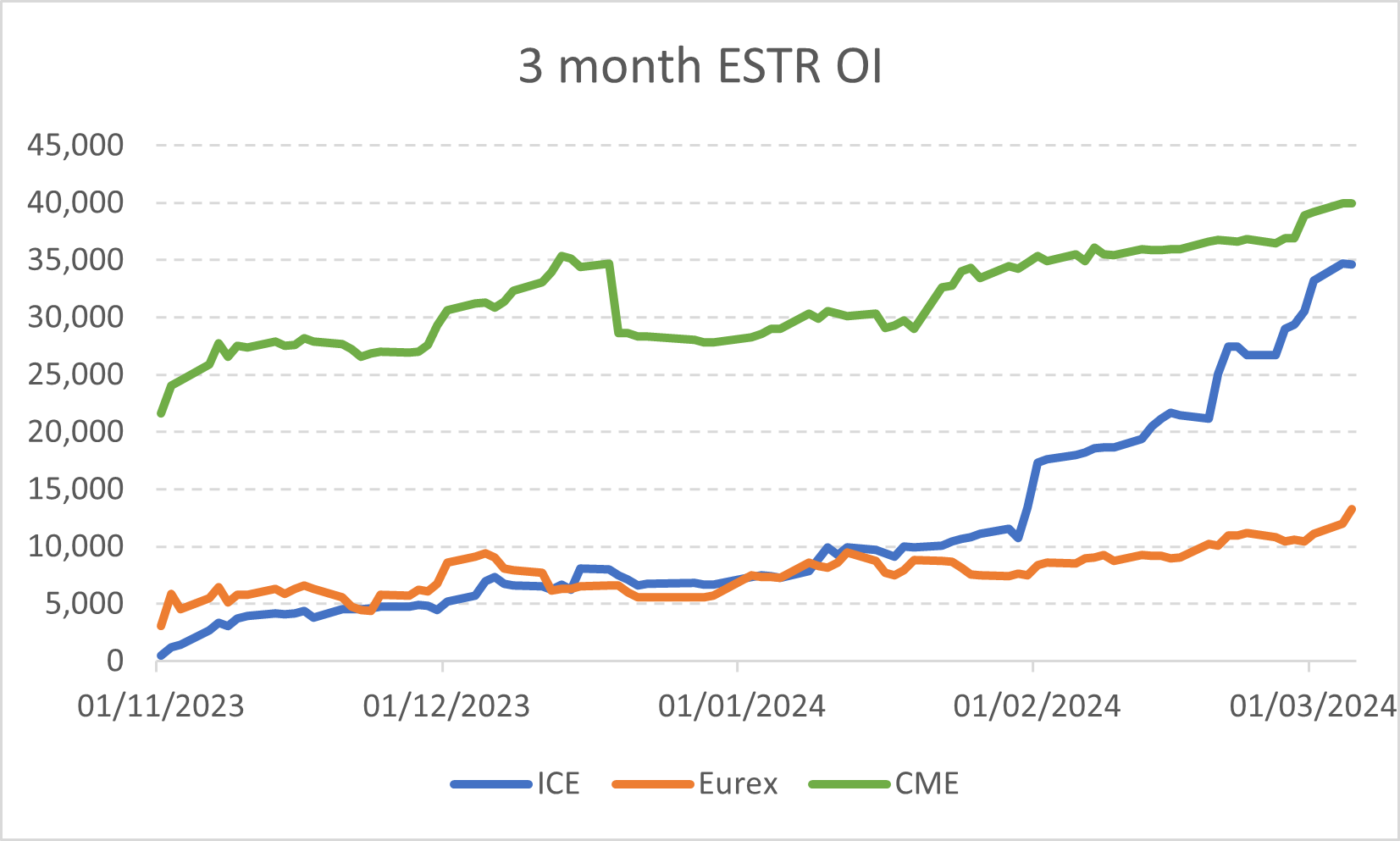

CME on March 5 hit an open interest record of 39,986 contracts in its three month ESTR futures (plus an additional 4,660 basis spread contracts), compared to 34,723 lots for ICE and 13,295 lots for Eurex, which were also records in a sign of the growing maturity of the products across the competing venues.

All three venues have seen open interest creeping up day-by-day since the beginning of February as liquidity measures and rates uncertainty drive use of the European risk free rate (see graph 1).

CME, which has been the market leader for open interest since the European risk-free rate derivatives were introduced, was the first mover in ESTR derivatives after launching the first risk-free rate future at the end of October 2022. Including the US exchange's Euribor/ESTR spread contracts, its open interest record stood at 43,739 lots on March 4, according to the exchange.

CME at the start of this month launch its latest market-maker program, aimed at improving pricing in contracts at expiry dates out for two years (dubbed “whites” and “reds”), and that has helped harness the recent momentum behind open interest, according to its head of European rates.

“We have seen a string of open interest records, and that is a natural indication of a growing market and the effectiveness of the market-making program extension we rolled out at the start of the month,” Mark Rogerson, EMEA head of interest rate products at CME said in an interview. “While it's early days, we designed it with the goal of tightening bid/ask spreads on Whites and Reds, and it is certainly the case that we have seen that spread tighten to within half a basis point, which is in line with what you want to see in a healthy market.”

Analysis of market volume data shows that trading of outright contracts (those that are unhedged or coupled to a leg) at CME are on the rise, with outrights making up 21% of the overall flow on Friday, versus a year-to-date average of 12% on the exchange, in a further sign of an increase in client positioning.

ICE launched in November its ESTR future with inter-commodity spread functionality to its vast Euribor market, and the US group also offers margin offsets contracts between ESTR and Euribor.

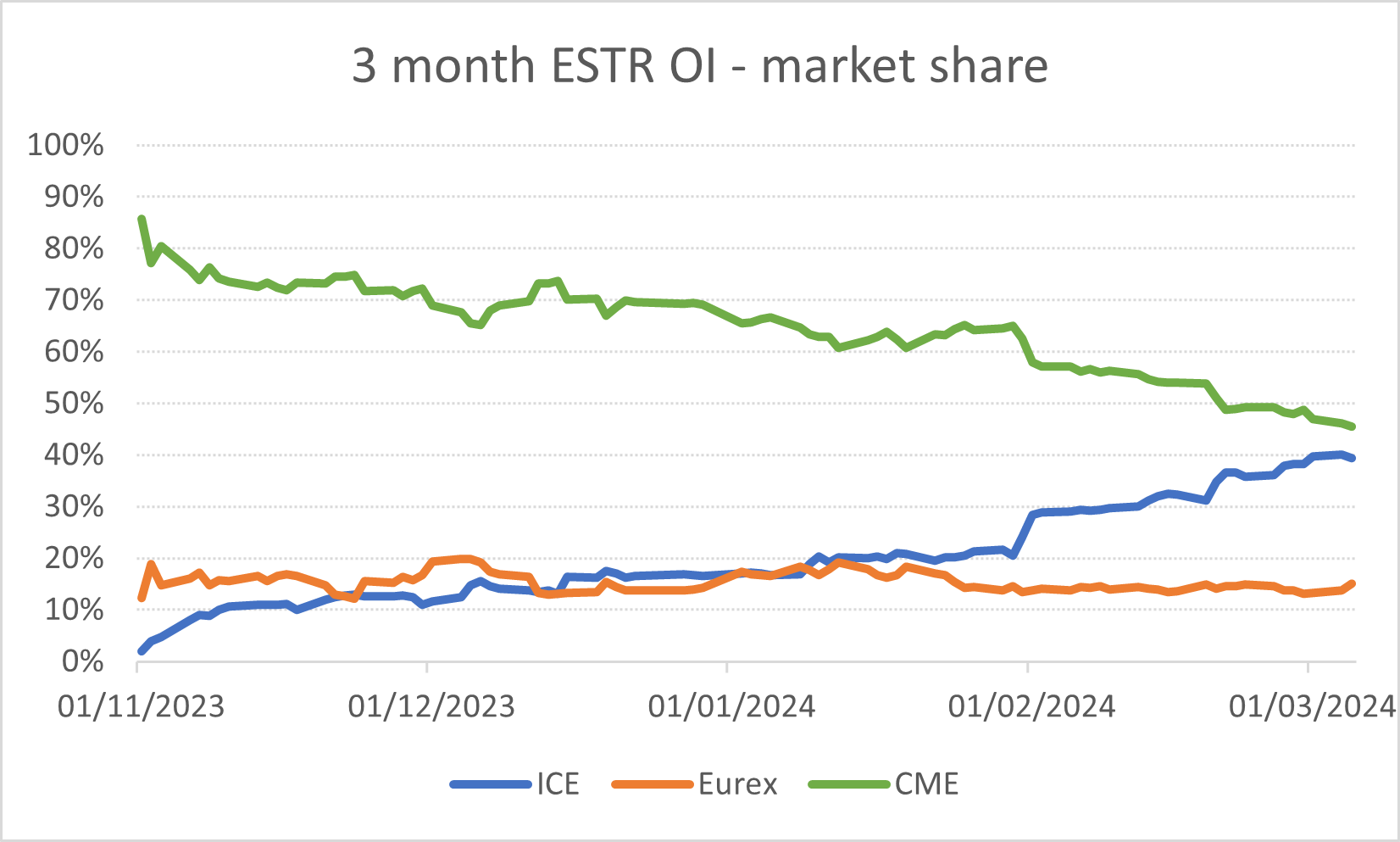

ICE Futures Europe hit a high of 68,558 lots traded on February 8 and the ICE market has made the greatest gains in terms of open interest market share versus the other two exchanges (see graph 2).

"We’re continuing to see a diverse and growing participant base trading our ESTR futures alongside Euribor, with the portion of end clients increasing substantially which is contributing to strong open interest growth,” Stelios Tselikas, head of interest rate derivatives at ICE, said in an emailed statement.

Graph 1

Graph 2

Source: Exchange data

So-called “top of book” data provided by ICE, a gauge of the average bid/ask contracts available at the best price covering the period since November 1, showed ICE is still ahead by this measure at 644 contracts, compared to 284 and 190 lots for CME and Eurex.

Deutsche Boerse-owned Eurex, meanwhile, has pulled ahead in volume terms. The firm hit 79,499 lots in traded volume on March 4, its highest level since the 83,652 contracts traded on February 20. The German market's average daily volume in February was 80,382 contracts, compared to 24,643 lots for ICE and 11,383 contracts for CME, according to data from the exchanges.

The first three days of March trading has seen CME ESTR volume rebound to a daily average of about 25,000 lots while Eurex traded a daily average of 70,000 lots at the start of this month and ICE traded 29,000 each day in the first three days of March.

FOW data shows that open interest at Eurex stood at 5,742 contracts at the end of December, meaning Eurex open interest has grown 132% since the end of last year.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you