Energy market volatility brings cashflow headaches to gas and power markets

By Sean O'Brien, Head of Sales, OpenGamma

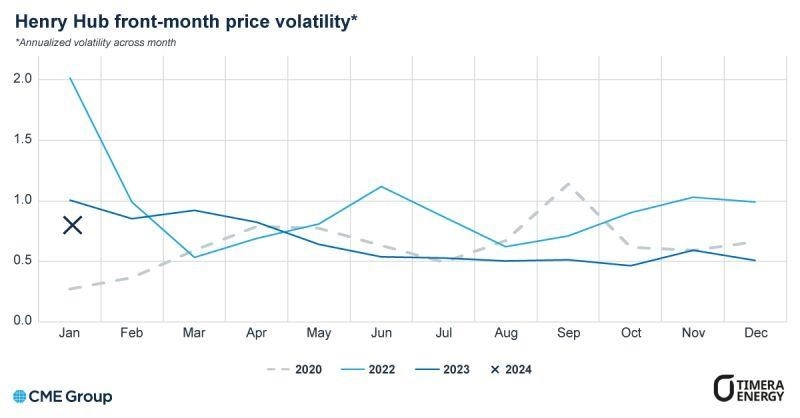

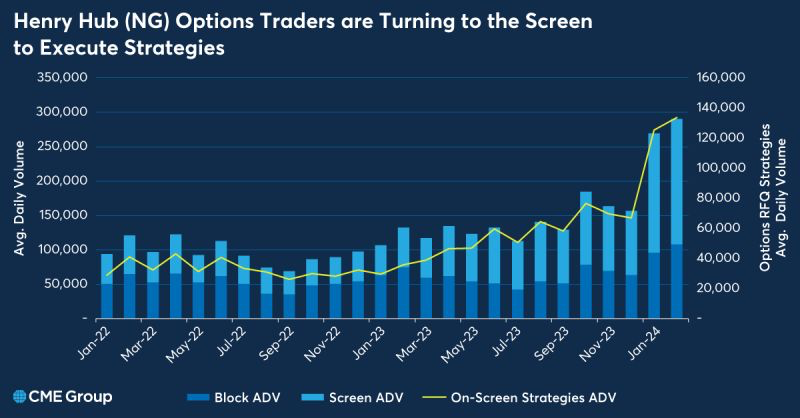

The changing weather conditions across the US continues to create volatility across energy markets. Last month, the cold front that glided through the US caused a spike in Henry Hub front-month volatility, driving record Henry Hub options volume. A staggering 300,000 electronic Henry Hub Natural Gas options were traded on screen as volatility jumped amid winter weather forecasts across the US. In total, CME Group cleared 1.5 million Henry Hub futures and options contracts in January.

Source: CME Group and Timera Energy

Source: CME Group

From extreme weather conditions leading to power grid issues in places like Texas, to the ongoing transition from traditional energy sources to renewables, there have been numerous factors contributing to increased price volatility across energy markets over recent times and there are more sources on the horizon.

For instance, US natural gas prices have plunged to a near-three-decade low this month as demand for the heating fuel as production surges to record levels following the country’s warmest winter on record. Looking further afield, Middle Eastern geopolitical tensions continue to affect supply chains, while a potential Trump presidential victory could see a reversal of the Inflation Reduction Act which could restrict investment in green energy.

There is no escaping the fact that events can have a huge impact on operating cash flow. As we witnessed at the peak of the volatility two years ago, firms used a combination of actions to not only to meet margin calls, but to also meet numerous other financial commitments. These actions ranged from raising money and increase borrowing, to reducing hedging activity and switching to non-cleared bi-lateral trades instead of exchange/cleared trades.

To ensure that firms are protected against future shocks, chief financial officers (CFOs) and chief risk officers (CROs) are investing in processes to help forecast future cash flows across physical and derivative trading. Whilst this exercise requires input from various different systems and data sets, the area which provides the biggest headache is forecasting cashflows related to initial margin.

Traditionally firms have used their existing risk systems, using value at risk (VAR) to forecast initial margin requirements but as we saw in 2022, it fails to capture the specificities of the exchange initial margin models. This creates huge variances between forecasts and actual requirements making forecasts worthless.

This problem is amplified when options are included in a portfolio. Henry Hub Options as an example are premium-paid upfront contracts that generate NLV (Net Liquidating Value) which can be used to offset the Initial Margin Requirement and can significantly alter any cash forecast. The initial margin (IM) on options is dependent on predicted moves in underlying price and volatility that can impact potential losses as well as offsets with other parts of the portfolio, again making cash flow forecasting even more difficult to plan for.

Due to these complexities, firms are moving away from VAR and towards systems that replicate the behaviour and components of the exchange margin models, improving their ability to forecast future cash flows which in turn impacts how much liquidity buffers are required.

The alternative approach is to hold excess cash reserves to cover all market events but given the higher interest rate environment which looks like it’s here to stay, the cost of such an approach is too costly for many.

As the energy market continues to grapple with volatility, trading firms must carefully evaluate their margin management strategies. With volatility showing little signs of disappearing anytime soon, balancing the delicate trade-offs between cost efficiency and risk mitigation will be crucial for energy trading firms seeking to thrive in an environment marked by constant fluctuations and uncertainties.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you