The Rise of 0-DTE Options: SPY Trading Behavior on FOMC Meeting Day

By Garrett DeSimone, PhD and Oscar Shih, OptionMetrics

The popularity of 0-day to expiration (0-DTE) options among investors has surged since their introduction in 2022. Given the relatively recent emergence of 0-DTE options, research into their intraday behaviour is still in its early stages. In this post, we will examine the trading volume of SPY options around the most recent FOMC meeting on September 20 2023.

Analysing 0-DTE behaviour during FOMC announcements holds particular interest for several reasons. First, the unique nature of 0-DTE options makes them well-suited for trading in response to event risk. These options have extremely short expiration dates and possess significant gammas. The presence of high gamma values implies that they can yield substantial returns when the underlying asset experiences sudden price movements, often triggered by unexpected news events.

Secondly, the FOMC decision stands out as one of the rare scheduled events that unfolds during regular market hours. The announcement of interest rate decisions occurs at 2pm, followed by a subsequent press conference hosted by the Fed Chair. Consequently, it is reasonable to assume that 0-DTE options traded on this day are specifically designed to account for the associated risks tied to this significant event.

In our study, we leverage the IvyDB Signed Volume Intraday dataset from OptionMetrics. We classify each trade into bid volume, ask volume and mid volume categories based on the execution price and the bid-ask price at the time of the trade. Our research has demonstrated that Signed Volume has the capacity to enhance factor returns, such as the put-call-ratio (you can read more about it in our post here), and can approximate the dynamics of a market maker's order book (detailed in our post here).

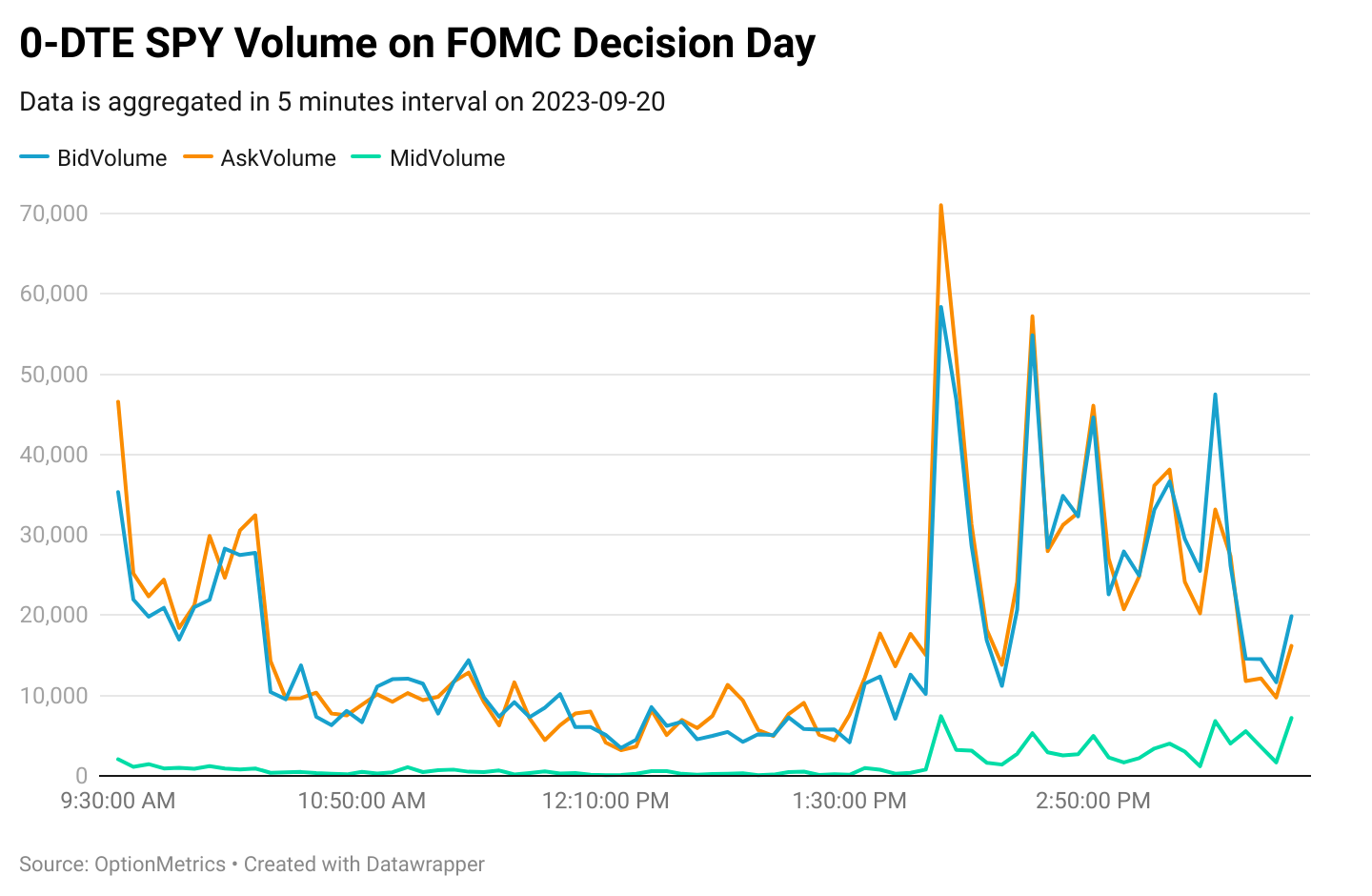

Graph 1, displayed below, illustrates the aggregated trade volume of 0-day to expiration (0DTE) SPY options, plotted in five minute intervals, during the most recent Federal Open Market Committee (FOMC) meeting day. In line with previous research on 0-DTE options, we observe a larger proportion of trades executed at the ask price during the market open. This corresponds with the prevailing narrative of end-users taking positions in long vol.

Furthermore, we note a subsequent surge in trading volume right after the 2pm rate decision, which aligns with increased trading activity following the committee's decision to maintain the same level of rates. Naturally, our next step is to delve deeper into the distribution of volume across different moneyness levels and between put and call options before and after the announcement.

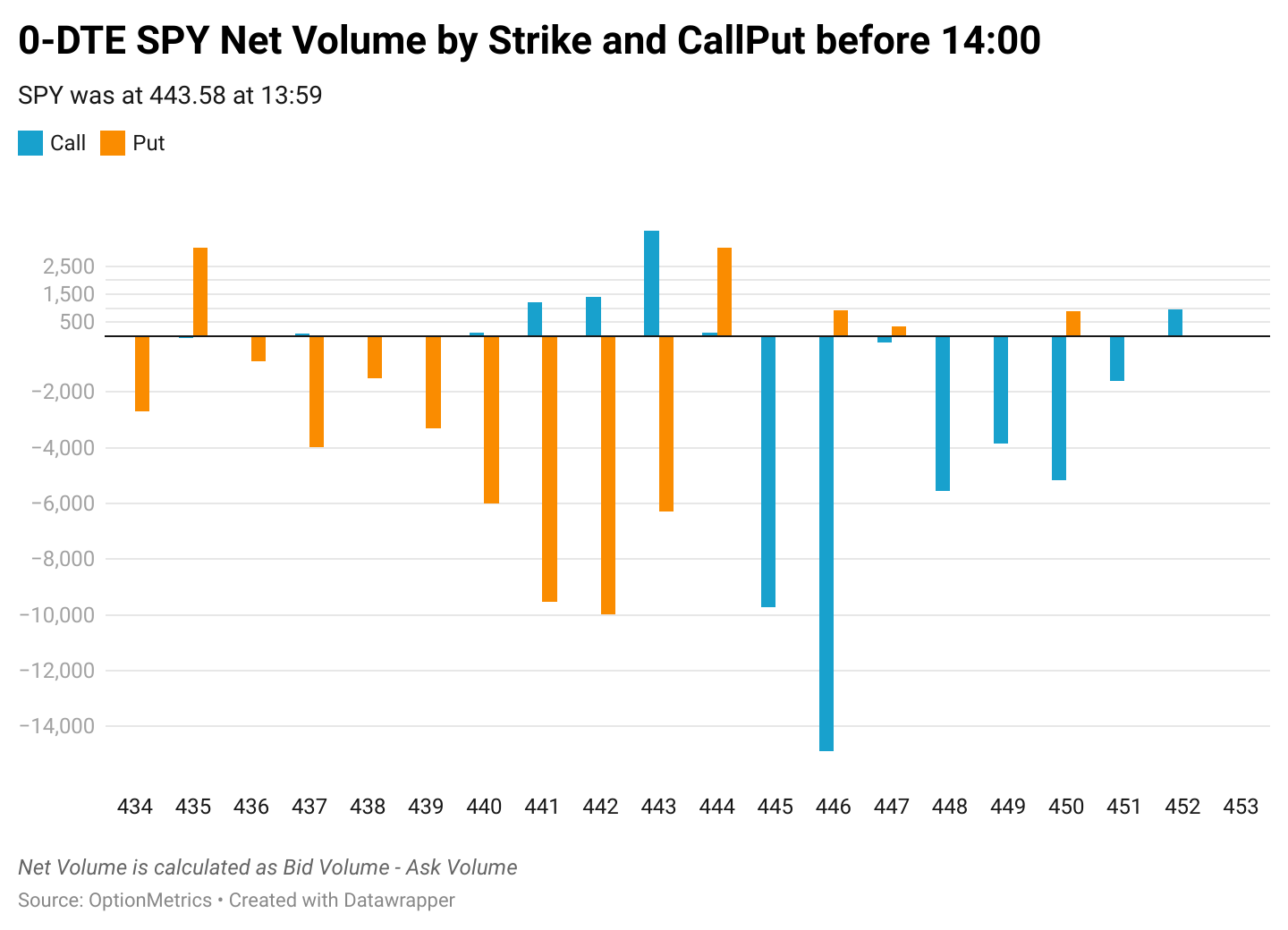

In the following charts we look to classify net volume in order to gain a better understanding of end-user positioning. Since market makers serve a liquidity function, bid volume is treated as market maker purchasing of contracts and ask volume as sold. End-users represent the counter party, therefore from an investor positioning can be viewed as the opposite direction of market-maker volume. Graph 2 is the aggregated net volume by strike for 0DTE calls and puts before 2pm on 2023-09-20.

Our findings reveal that market-makers tend to hold significant net short positions on out-of-the-money (OTM) options and slightly net long positions on at-the-money (ATM) options just before the announcement. From an investor's perspective, this suggests their involvement in trades with the intention of achieving convexity payouts.

The positioning of these trades may also be influenced by a distinctive characteristic related to event risk associated with FOMC news. The market anticipates two most likely outcomes for stock prices following the news release, such as a 1% upward or downward move in SPY. Consequently, this leads to a concentration of trades centered around these more probable outcomes.

Interestingly, end-users are in short positions for the nearest ATM options with a strike price of 443 and 444, indicating a short gamma exposure. This situation could arise from various multi-leg trade structures, or investors might be seeking to capture a significant embedded volatility premium before the announcement.

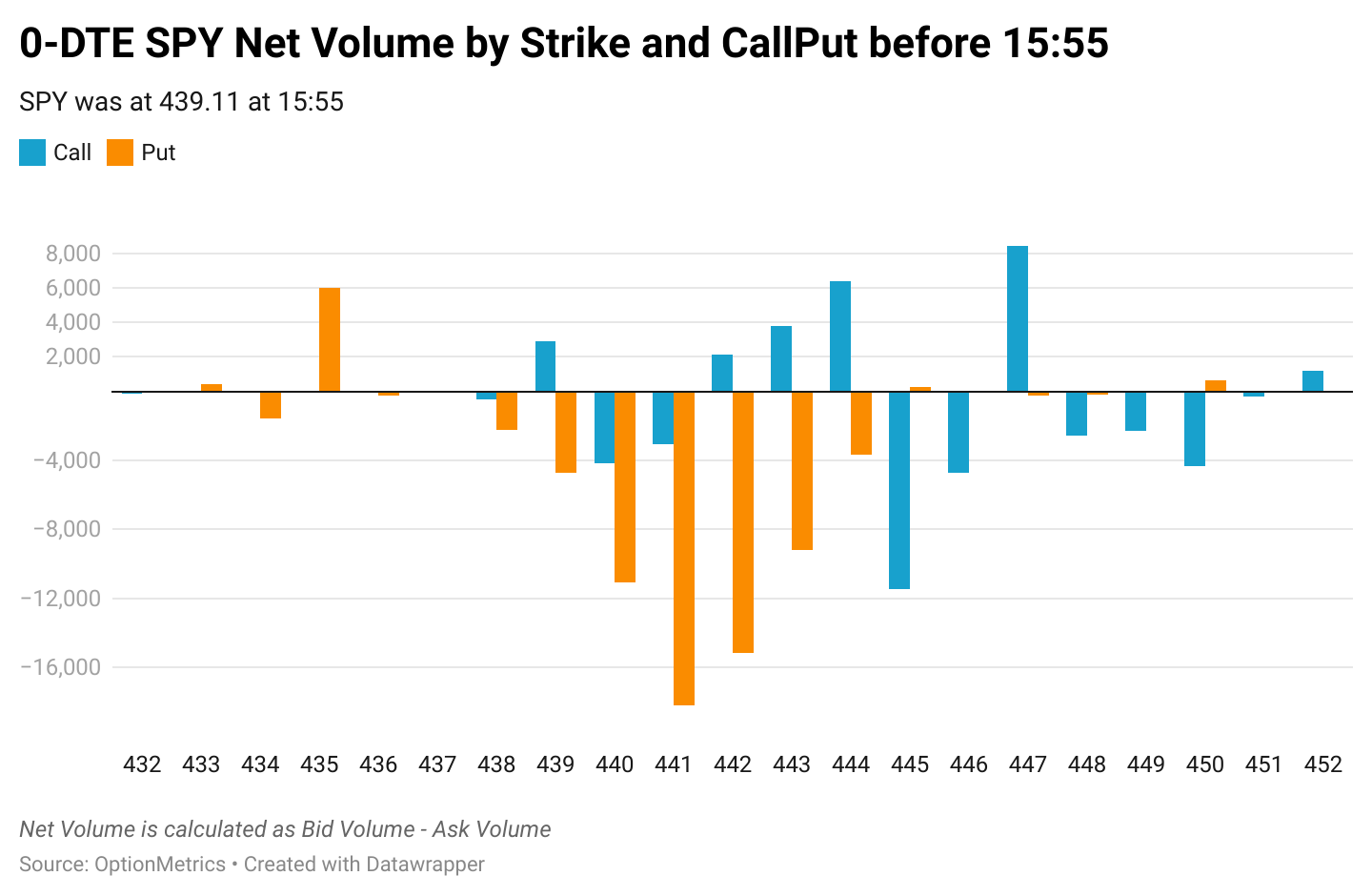

Following the Fed announcement, the distribution of 0-DTE SPY trades concentrated on in-the-money (ITM) put options, for which market-makers had net short positions. The equity market responded negatively to the Fed's declaration of "higher rates for longer" during the rate decision and subsequent press conference. After 2pm, SPY experienced a nearly 1% decline, consequently moving a substantial portion of out-of-the-money (OTM) put options into the money.

Our analysis of 0-DTE options, particularly in the context of SPY trading on the day of the September 20 2023 FOMC meeting, has revealed significant insights into their dynamics. These short-term options, well-suited for event-driven trading, exhibited concentrated activity around the time of the FOMC announcement and the subsequent press conference. Notably, market-makers held net short positions on out-of-the-money options, while end-users strategically positioned themselves for potential market movements due to potential price jumps from the news.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you