'New weather patterns' boost demand for soft commodities - ICE

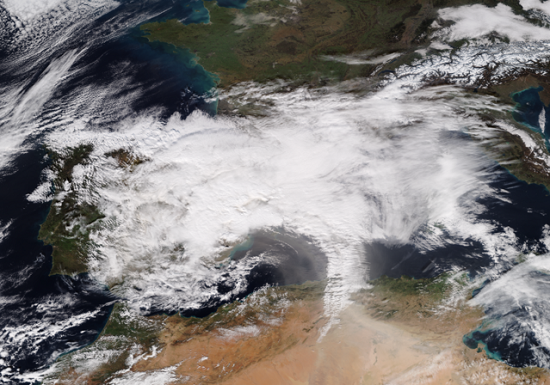

New weather patterns and their impact on commodities are partly behind increasing demand for Intercontinental Exchange’s soft commodities hedging products, the US exchange has said.

The Atlanta-based group said trading volumes in its soft commodities segment, which includes sugar, coffee, cocoa and cotton hedging products, was up 22% in the first six months of this year compared to the same period last year.

At the same time, soft commodities derivatives open interest was up almost a fifth (19%) to 4.2 million lots.

Sugar derivatives have been in-demand, with trading volumes up 30% in the first half of this year compared to the same period in 2022 as sugar open interest rose 22% to 1.7 million lots. Coffee volumes were up a tenth in the first half, cocoa trading was up 17% and cotton trading activity was also up 10% year-on-year. ICE said cocoa futures and options volumes hit a one-day record of 1.4 million contracts on June 29.

David Farrell, chief operating officer at ICE Futures US, said in a statement: “As new weather patterns emerge and fundamentals change, participants utilise ICE’s deeply liquid markets to manage price exposure for these commodities which are so central to daily life.”

The data emerged a day after the US exchange group, which operates markets in the US, Europe, the Middle East and Singapore, said its average daily trading volume was up 5% in June, thanks largely to ICE’s energy segment.

ICE said on Thursday its energy average daily volume (ADV) was up 26% in June, which partly reflects slower demand in the middle of last year as markets reacted to the effects of the Russian invasion of Ukraine.

ICE’s oil ADV was up 34% last month, driven by a 29% spike in demand for the exchange’s flagship Brent crude oil contract.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you