Active ownership as a tool of greenwashing

When asset managers are criticized for the vast greenwashing happening in financial markets (EDHEC, 2021), the answer is often that greenwashing is only an issue for passive investments, while active strategies – particularly active ownership – can fix all these problems. Investors preoccupied with climate change can be “active owners” and influence the carbon footprint of investee companies by voting at shareholder meetings on climate-related issues and by actively engaging with executives and board members. We study to what extent institutional investors’ ownership affected corporate carbon emissions in 68 countries for the period from 2007 to 2018 and find that institutional investment on average does not appear to lead to any tangible carbon footprint reduction.

Although national governments have pledged to reduce their greenhouse gas emissions, delivering on their promises will require significant changes in the production and consumption of energy by the sources of these emissions, primarily companies. The financial system is increasingly aware of the risks posed by climate change (Krueger et al., 2020; Bolton and Kacperczyk, 2021) and, accordingly, many financial actors are making investment decisions to reduce their exposure to assets – primarily securities issued by companies – particularly sensitive to climate risks. Because public and private pension schemes, insurance companies, sovereign wealth funds, mutual funds and other institutional asset managers have a long-term investment horizon, the reduction of medium to long-term risks such as climate change is for them of paramount concern (Gibson et al., 2021; Krueger et al., 2020). Moreover, many of those institutional investors also have substantial direct and indirect exposure to sectors that are particularly exposed to climate risks, such as infrastructure and energy.

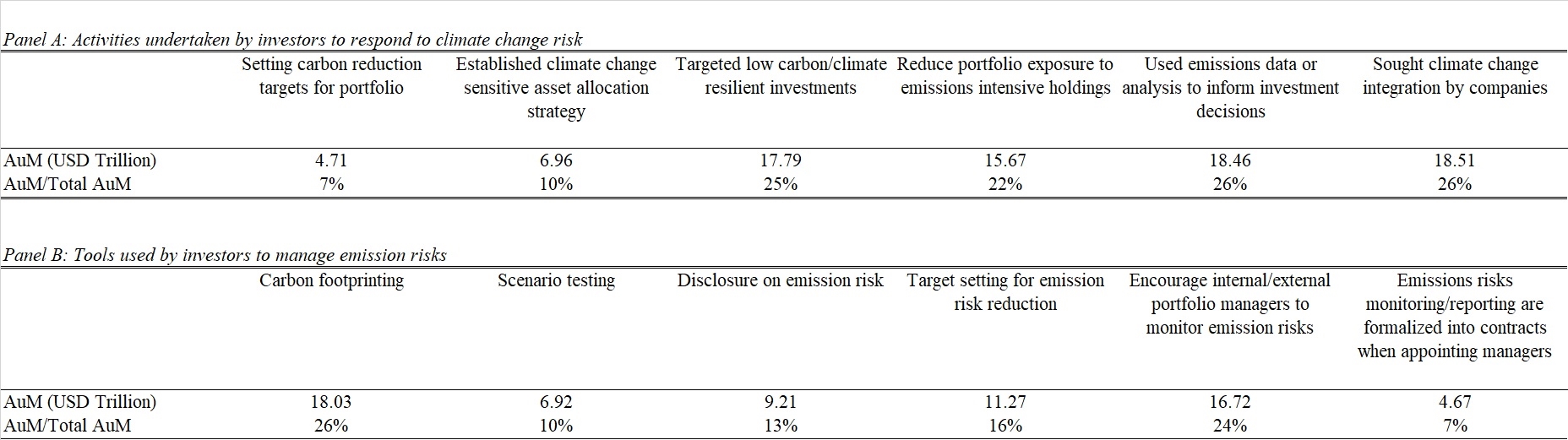

Initiatives to promote the integration of sustainability into investment decisions are gaining momentum. For example, the vast majority of global institutional investors have now signed the United Nations Principles for Responsible Investment (UNPRI), committing to the integration of ESG factors, including climate change, into their asset management operations. Active ownership is considered an essential ingredient in the implementation of institutional investors’ sustainability commitments. In the Table below we show what tools and activities UNPRI investors declare they are using in relation to climate risks. Investors accounting for about 26% of the total Assets under Management (AuM) report that they are actively seeking the integration of climate change concerns in the operations of investee companies.

Table: Activities and tools used by institutional investors reporting to UN PRI

In general, active ownership encompasses both engaging with the management and boards of directors of investee companies and proxy voting on issues concerning governance and performance, including those related to the environmental strategy (Dimson et al., 2015, 2019). Active ownership approaches vary widely across investors and geographies, but they usually involve mobilizing public opinion and the media, in particular to bring attention to proxy votes on environmental issues at upcoming shareholders’ meetings. Other active ownership initiatives are rolled out behind the scenes and consist of discreet dialogue and interactions between investors and management and/or board directors.

Climate-focused active ownership measures are taken either independently or through collaborative endeavors (Dimson et al., 2019) such as the Carbon Disclosure Project (CDP) and the UNPRI itself. Collaborative engagements aim to encourage companies to disclose their climate change strategies, set emission reduction targets and take action on sector-specific issues such as gas flaring in the oil and gas sector. Examples of objectives in this area include ensuring compensation policies are consistent with environmental targets, and requiring improved disclosure and target setting from companies on their carbon price assumptions.

Whether active engagement by climate-aware investors can actually affect investee companies’ carbon footprint is an empirical question with relevant implications for responsible asset management and climate policymaking. In particular, assessing the relationship between climate-aware investors and carbon footprint would shed light on the ability of finance to contribute to the transition towards a low-carbon economy as a complement, or even as a substitute, of climate policymaking. Importantly, institutional investors own assets that are neither currently nor effectively covered by existing national climate policies. And even in jurisdictions with a carbon taxation mechanism in place institutional investors are owners of businesses currently not included for instance in cap & trade frameworks. Therefore, climate-aware institutional investors can, in many ways, potentially complement or even replace the existing national and international carbon policies.

We study to what extent institutional investors’ ownership affected corporate carbon emissions in 68 countries for the period from 2007 to 2018. The results show that institutional investment on average does not appear to lead to any meaningful reduction in carbon footprint (measured as CO2 emissions and carbon intensity). However, institutional investors are associated with a limited carbon footprint reduction for the highest polluters in the sample. Thus, responsible investors can help the decarbonization of investees but are unlikely to play a major role in the low-carbon transition unless their active ownership becomes more effective.

COP26 has disappointingly been a missed opportunity for the planet. Finance was at the very centre of most COP26 discussions and is often identified as a solution to the inaction of governments. Our analysis shows that institutional shareholders do not reduce their investees’ carbon footprint in any meaningful way but they do contribute to carbon emission reductions in the most polluting companies. However, even for the highest emitting companies in our sample, the carbon footprint reduction is of a limited magnitude. Therefore, active ownership – as it has been carried out so far – is not a solution in the fight for climate change but, at best, a tool of greenwashing.

References

Amel-Zadeh A. & G. Serafeim, 2017, Why and How Investors Use ESG Information: Evidence from a Global Survey, Financial Analyst Journal

Bolton P. & M.T. Kacperczyk, 2021, Do investors care about carbon risk?, Journal of Financial Economics, ISSN: 0304-405X

E. Dimson, O. Karakas & L. Xi, 2015, Active Ownership, Review of Financial Studies, 28(12): 3225–3268

Dimson, E., Karakaş, O. & L. Xi, Coordinated Engagements, European Corporate Governance Institute – Finance Working Paper No. 721/2021, SSRN: https://ssrn.com/abstract=3209072 or http://dx.doi.org/10.2139/ssrn.3209072

Dyck, A., K.V. Lins, L. Roth & H.F. Wagner, 2019, Do Institutional Investors Drive Corporate Social Responsibility? International Evidence. Journal of Financial Economics, Volume 131, Issue 3, 693–714

EDHEC, 2021, Doing Good or Feeling Good? Detecting Greenwashing in Climate Investing: https://www.edhec.edu/fr/publications/doing-good-or-feeling-good-detecting-greenwashing-climate-investing

Krueger, P., Z. Sautner & L. Starks, 2020, The Importance of Climate Risks for Institutional Investors, Review of Financial Studies, Volume 33, Issue 3, Pages 1067–1111: https://doi.org/10.1093/rfs/hhz137

UNPRI, 2011, Universal Ownership: Why environmental externalities matter to institutional investors, PRI Association and UNEP Finance Initiative, 2–60

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you