Post-trade in Europe – a 20 year harmonisation journey

This article is the first in the series What’s Next in Post-trade Regulation?, a guest column from Citi which will take a look at some of the major regulatory transformations currently underway in Europe’s capital markets. All articles in the series can be found here.

Post-trade in Europe – a 20 year harmonisation journey

By Marcello Topa, Director, Market Policy and Strategy within Citi’s EMEA Securities Services team

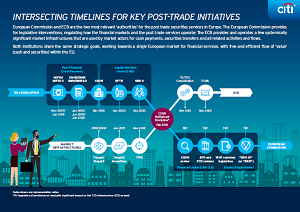

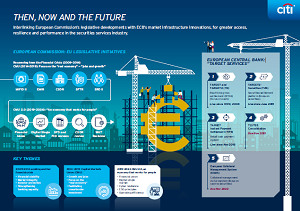

In order to promote cross-border investment in the EU, there needs to be a much greater degree of harmonisation in post-trade activities across member states. Deficiencies – known as the Giovannini Barriers - inhibiting efficient cross-border clearing and settlement were first identified in 2001 and again in 2003. Since then, remarkable progress has been made. The European Market Infrastructure Regulation (EMIR) has implemented EU-wide standards on OTC (over-the-counter) derivative clearing and reporting, while the Central Securities Depositories Regulation (CSDR) established a common supervisory framework for CSDs, in addition to introducing an EU-wide T+2 rolling settlement cycle. Meanwhile, the European Central Bank’s (ECB) Target2-Securities (T2S) platform – despite extensive delays – has helped to harmonise settlement practices in participating EU countries.

Weak links need to be ironed out

However despite the positive intentions of CSDR, its Settlement Discipline Regime (SDR) – which introduces mandatory buy-ins and tough financial penalties for settlement fails- does have flaws. The International Capital Markets Association (ICMA), for example, pointed out that the number of settlement fails during Covid 19’s volatility peak increased significantly in absolute terms. ICMA added that had the CSDR’s mandatory buy-in regime been in place during this tumultuous period, it could have created further instability and potential systemic risks, “further amplifying the already extreme dislocations.”

There are also industry concerns about SRD II (Shareholder Rights Directive II), a directive aimed at promoting greater shareholder engagement with issuers –which went live in September 2020. Most notably, local regulators have faced criticism from intermediaries for adopting different interpretations of the rules. As SRD II is a Directive – as opposed to a regulation – member states have a degree of autonomy in how they transpose the rules into local law, which has led to a number of divergences. This lack of coordination has done little to further the EU’s harmonisation objective.

Despite having earlier asked for a delay to SRD II, a consortium of industry groups (including the Association for Financial Markets in Europe, the European Banking Federation and the Association of Global Custodians, etc.) have since confirmed that they are committed to implementing the rules, but conceded not all of the required operational processes will be in place.

Although major improvements have been made in post-trade in the last two decades, a lot more work still needs to be done in other areas to boost cross-border clearing and settlement. The European Post-Trade Forum (EPTF), a body of industry experts established by the EC which was entrusted with helping the EU authorities root out additional barriers hampering cross-border clearing and settlement, issued a report in 2017, charting some of their ongoing concerns.

The report highlighted a number of operational and structural weaknesses in EU capital markets, including the fragmented approach taken by member states towards corporate actions and general meetings, inefficient withholding tax collection procedures (e.g. a lack of exemption at source, arbitraging reclaim processes, long repayment periods in some member states); a lack of harmonisation in registration and investor identification rules and processes; overly complex post-trade reporting structures; and an uneven application of the asset segregation rules. Unfortunately, many of these barriers and weaknesses are still in place three years later.

Regulators continue the harmonisation drive

This year, EU policymakers have sought to inject life back into the Capital Markets Union (CMU), a scheme first outlined in 2015 designed to encourage competition and financial integration, but which until recently had gone quiet during the formation of the new European Parliament and European Commission (EC). By committing to CMU once again, EU policymakers are looking to create more diversified sources of funding; enhance financial stability; and nurture long-term cross-border investment.

Furthermore, recent post-trade regulations will bring greater cohesion to European capital markets. Although elements of the SDR have faced criticism from many industry participants, the new rules are expected to reduce the volume of settlement fails.

Moreover, the SRD II will have a significant impact on financial intermediaries such as custodians and CSDs. Regulators believe financial intermediaries could play a vital role in facilitating shareholder engagement. Under the requirements, issuers can ask intermediaries to provide details about their shareholders on a timely basis. Additionally, intermediaries must supply shareholders with information in good time about meeting arrangements and other corporate events. Following productive industry dialogue, it was agreed this information will be disseminated in a standardised messaging structure leveraging newly created messages in ISO 20022 format. Again, this aspect of SRD II is hugely positive and will play a meaningful role in speeding up harmonisation throughout the EU. Elsewhere, the European Securities and Markets Authority (ESMA) recommended further harmonisation between UCITS and the Alternative Investment Fund Managers Directive (AIFMD).

Industry-wide efforts are still underway to eliminate market fragmentation in post-trade. In July 2020, the High Level Forum - a group of 28 capital markets experts - organised by the EC, published a “New Vision for Europe’s Capital Markets” with 17 recommendations to guide the Commission’s future plans on the CMU , which covered post-trade extensively.

Covid-19 – a driver for harmonisation?

Covid-19 has had a very disruptive impact on regulatory timetables. CSDR’s SDR, for instance, was delayed from September 2020 until February 2021, and may possibly be postponed even further to February 2022 subject to policymaker discretion. Industry experts hope this temporary reprieve will result in amendments being made to the mandatory buy-in regime – despite not having been introduced yet – in the upcoming CSDR review.

Other provisions - such as the final two phases of EMIR’s initial margining requirements for uncleared OTC derivatives and the consolidation of T2S with TARGET2 - were also pushed back. Despite the short-term disruption, Covid-19 could in fact incentivise policymakers into making an even greater effort to deliver on integration and harmonisation. Regulators acknowledge that harmonised marketplaces function better during stressed periods than those rife with idiosyncrasies and inconsistencies. With a renewed focus on operational resiliency, EU regulators are likely to advocate the case for greater standardisation.

Making a difference

To ensure that clients’ interests are fully protected and markets operate as they should, Citi plays a major role in advocacy efforts in the EU. Through its participation in industry working groups, regular engagement during technical discussions and consultations and frequent, ongoing dialogues with global regulators, Citi is committed to supporting clients’ requirements and improving best practices.

|

Citi is an active proponent for deeper integration and harmonisation in European capital markets. The bank is a co-chair on the SRD II Industry Steering Group, an informal body comprised of experts drawn from issuers, CSDs, intermediaries and banks, which has been heavily involved in developing new market standards for shareholder identification requests and general meeting procedures.

As part of this, the bank helped establish the ‘golden operational record” (GOR), a set of standardised templates containing all of the information required during corporate event announcements. It also spearheaded Proxymity, an electronic proxy voting platform, which has since become the industry standard, and will help support organisations’ SRD II compliance efforts.

Citi is also involved in a number of industry groups and discussions related to CSDR and T2S, including the Advisory Group on Market Infrastructures for Securities and Collateral (AMI-SeCo), the Harmonisation Steering Group (HSG) and the Market Settlement Efficiency workshops organised by the ECB’s T2S team. Citi is also actively supporting the ECB’s “Single Collateral Management Rulebook for Europe (SCoRE)” which is expected to provide the basis of extensive harmonisation and efficiency in various processes surrounding the use of securities as collateral in various forms of secured financing transactions (also including asset servicing and withholding tax reclaim procedures). |

The material provided is for informational purposes only. Information is believed to be reliable but Citigroup does not warrant its accuracy or completeness. Citigroup is not obligated to update the material in light of future events. This does not constitute a recommendation to take any action, and Citigroup is not providing investment, tax accounting or legal advice. Citigroup and its affiliates accept no liability whatsoever for any use of this information or any action taken based on or arising from the material contained therein.

© 2020 Citibank, N.A. (organized under the laws of USA with limited liability) and/or each applicable affiliate. All rights reserved by Citibank, N.A. and/or each applicable affiliate. Citi and Arc Design is a trademark and service mark of Citigroup Inc., used and registered throughout the world.

This is the first article from the series and here you can find the rest of the published ones, starting from the most recent one:

- The fifth article Moving with the times: Updating the SFD discusses how the Settlement Finality Directive (SFD) has been instrumental in strengthening capital markets and mitigating systemic risk by harmonising - across member states - the legal protections for market infrastructures and their participants. By Marcello Topa.

- The fourth article SRD II – Ironing out the creases discusses the Shareholder Rights Directive II (SRD II) legislation aimed at enhancing shareholder rights. By Marcello Topa.

- The third article Enabling Digitalisation in Europe discusses the major digitalisation process and adopting new innovative technologies, as it looks to improve client experiences and support emerging asset classes. By Marcello Topa and Ryan Marsh.

- The second article in the series is CSDR: The saga continues, by Marcello Topa.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you