AFX chief sounds "clarion call" for minorities

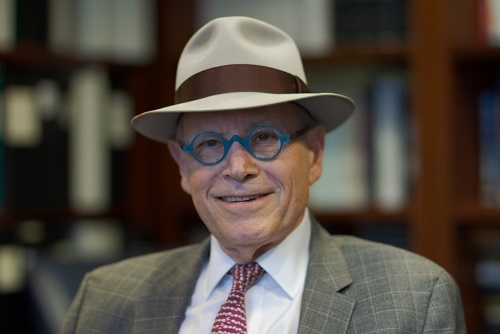

The chief executive of the American Financial Exchange (AFX) has highlighted the role of its benchmark rate Ameribor, the American Interbank Offered Rate, in promoting access to financial services for low and moderate income communities.

Richard Sandor has said that Ibors such as the Secured Overnight Financing Rate (SOFR) and SONIA, the Sterling Overnight Index Average, suit “the big money-centre banks" while Ameribor is better suited to the US’s approximately 5,000 regional, mid-sized and community banks and savings institutions.

“Our mission is to challenge existing models, to look at unconventional ways to do business, to champion average, forgotten American men and women, and middle-size banks that don’t normally have a voice and an advocate,” Sandor said at a webinar on Wednesday afternoon, which focused on how minority institutions and financial innovation can help to address challenges faced by minority and low-income communities.

“The minority community needs to create assets that are linked to their cost of borrowing, and a benchmark that is based on overnight unsecured lending does that.”

Sandor said AFX has formed a minority lending coalition to give small banks participations in loans that float to Ameribor. "This is not only a time for action, this is a clarion call for banks," he said.

Chris Giancarlo, former chairman of the Commodities Futures Trading Commission and an AFX director, said the demise of Libor was never meant to result in its replacement with a singular benchmark.

“There are alternatives to Libor such as SOFR which has been endorsed by the Alternative Reference Rates Committee, and that reflects the funding costs of large Wall Street banks that are primarily dealers of US treasury securities,” he said.

“But there are alternatives such as the Ameribor rate, which has been developed by the AFX, that is used increasingly by America’s regional, community and minority-owned banks, and they’ve spoken out about their need for a broad based interest rate benchmark that attracts unsecured bank borrowing and lending, which is more prevalent in the communities they serve.”

In an address, Jelena McWilliams, chairman of the Federal Insurance Deposit Corporation, highlighted the role of financial institutions in creating a sense of financial belonging.

“As the Covid-19 pandemic continues to disrupt the daily lives of Americans, we’re particularly mindful that minority communities have suffered disproportionately,” she said.

"We know that individuals from low and moderate income communities are often the least likely to have the very banking and financial services they need most.

"We have witnessed a nationwide conversation about racial inequality and other social issues that pose difficult questions across a wide range of policy areas, including banking and financial services overall.”

According to Sandor, AFX’s membership has grown from 10 members in 2015 to 203 members representing $3 trillion (£2.3tn) of total assets including community, midsize and regional banks.

“We went on over the last three years to recruit Hispanic banks, African American banks, Chinese American, Korean American and most recently Seneca Native American,” he said.

People’s Bank of Seneca, headquartered in Seneca, Missouri, was the first Native American bank to join the exchange.

Sandor noted that when the AFX set out its plan on providing liquidity to African American and other minority institutions, the number of African American banks in America stood at 21 out of more than 5,000.

“That statistic says it all,” he said. “13% of the population, 21 banks, there is clearly an issue here.”

In June, Sandor predicted a virtuous growth circle in the third quarter for its 30-day Ameribor futures as a growing number of banks tie commercial loans to the rate.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you