Why is APAC a Securities Finance region to watch in 2020?

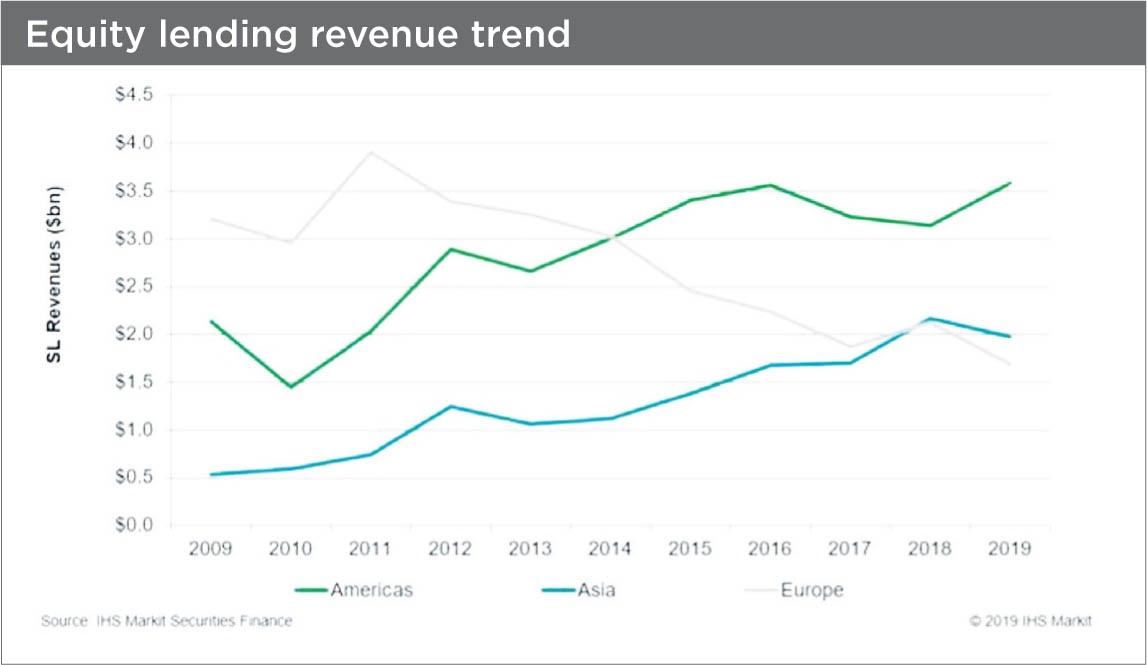

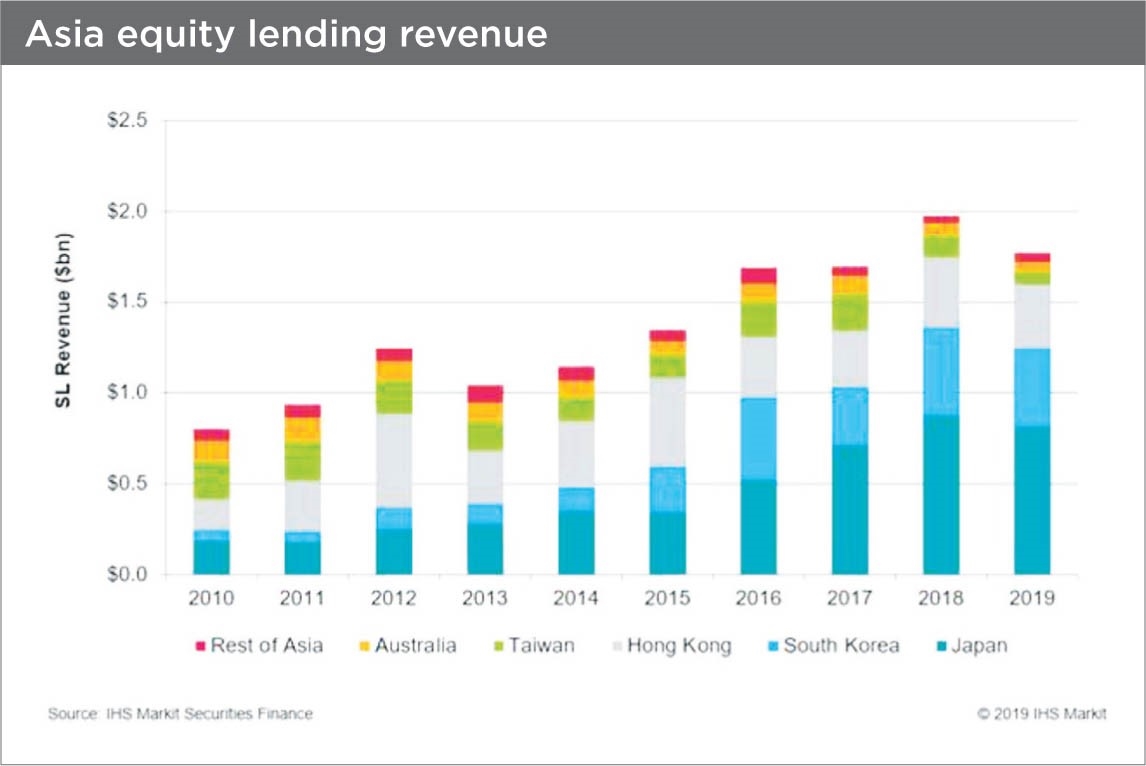

Equity lending revenue in APAC surpassed European revenues in 2018 and the gap continues to widen. It’s a story of two halves with European revenue posting a steady (45%) decline over the past ten years in contrast to APAC 120% rise.

The region has several vibrant emerging lending markets, such as South Korea and Taiwan driving growth. In addition, regulations may see China’s market open up to securities lending as they seek to open capital markets and attract more foreign investment.

What are the key Securities Finance markets in APAC?

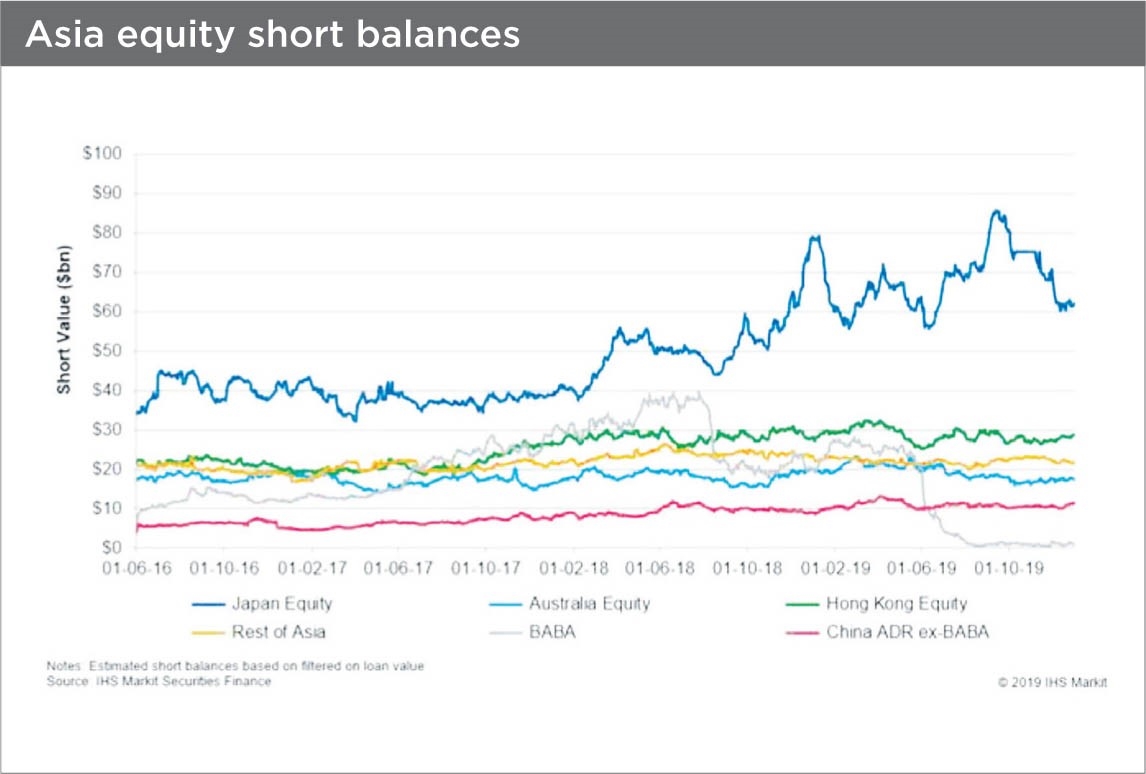

Japan is the most mature and remains the largest securities finance market in APAC. Due to Japan’s economic growth it has continues to attract short activity, despite signs of improving corporate governance and profitability. However, South Korea has seen strong revenue growth driven by highly special securities, such as HLB (pharmaceutical) and Meituan Dianping (Retail) and a substantial tech sector.

What was the impact of Coronavirus (Covid19) on China’s securities finance market?

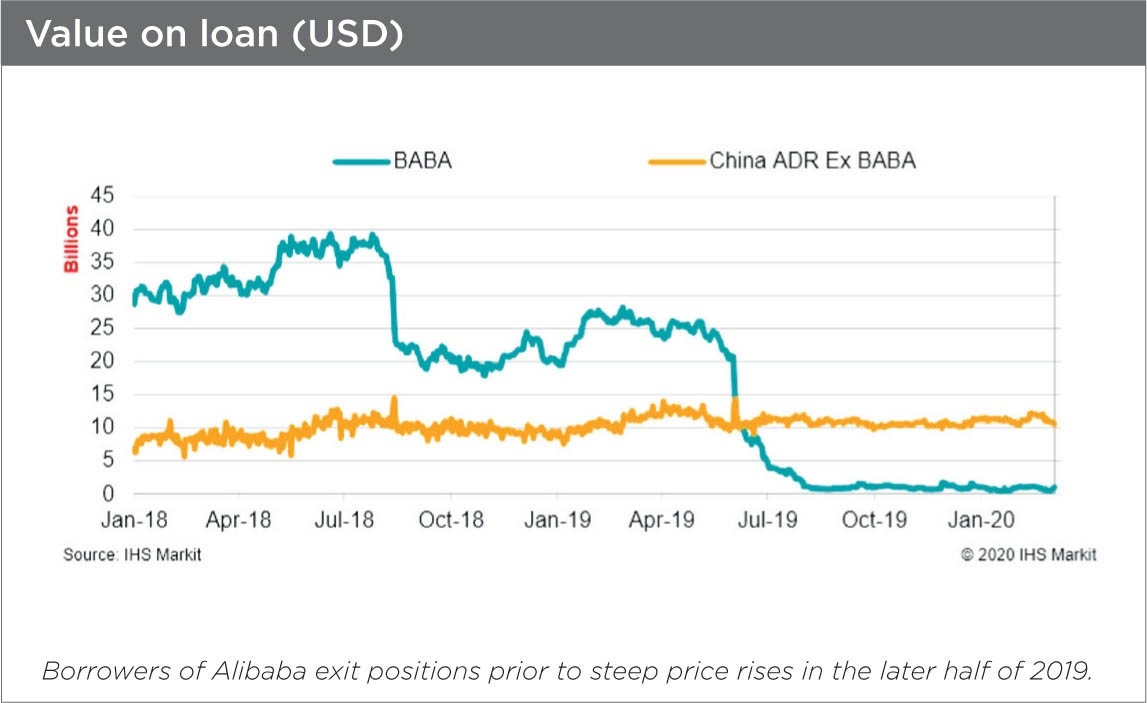

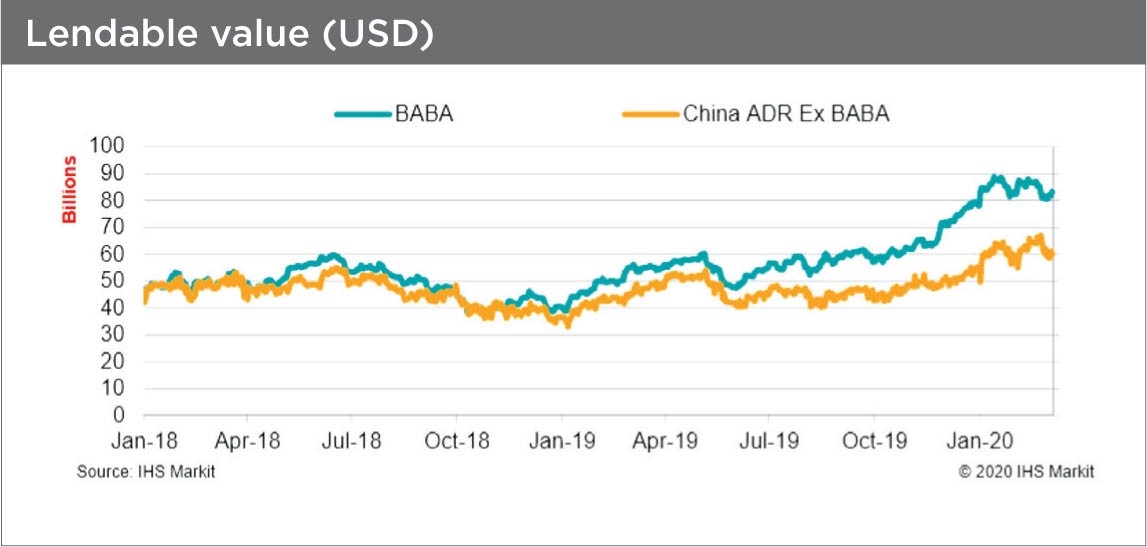

Because the Chinese finance market is restricted to domestic participants only, we used our data on the Chinese ADR’s as a proxy to identify any unique early trends related to the discovery of the virus. Per chart below, whilst the virus was detected in early to mid January, markets were slow to identify the potential impact of the virus.

What has been the regions reaction to the GPIF announcement they are suspending Equities lending?

The GPIF decision has highlighted to many beneficial owners the importance of maintaining a strong governance framework for their securities lending program. ESG has never been a higher priority and ensuring securities lending does not impact on voting and corporate engagement priorities is critical.

A governance framework not only covers corporate governance, but, it also details the type of program, approved securities, markets, collateral, counterparties, specific restrictions. Importantly, the governance framework should address default, and continencies around market events e.g. market volatility, short selling bans etc. and managing program risks.

Historically, most beneficial owners delegated the management of program risk to agent lenders and would rely on the Agent Lenders indemnification. However, regulations have seen indemnification costs rise making some low fee (GC) trades uncommercial.

Resulting in some beneficial owners choosing to take more control over their lending programs by moving to un-indemnified loans, peer to peer transaction, structured (e.g. TRS) and direct lending arrangements. These transactions switch the dial up on lending returns, but, also increase demand for oversight and enhanced risk analysis, such as VaR and ELOD, to assess and monitor counterparty exposure.

Having strong and well communicated framework allows beneficial owners to manage both internal stakeholders and continue to benefit from revenue generated from the lending program.

Why are Beneficial Owners looking to implement a Treasury function?

Whilst Phase 5 of the Initial Margin requirements are due to come into force in 2020, the majority of larger Beneficial Owners will be impacted by Phase 6 which is due to come into force in 2021. The IM will require Beneficial Owners to ensure they maintain daily collateral and liquidity for their their OTC positions.

For some Beneficial Owners this presents an opportunity to invest in resources to support Treasury like functions similar to Banks/Investment Banks, with daily cash placement/management capacity. To effectively manage cash relies on establishing overnight and term repo and as well as a credit team to support term and other structures. These changes will also employ additional operational and risk support staff to manage and oversee the operations including the management of collateral and margin calls.

Has the APAC region been impacted by activist short seller?

In many Asian cultures secrecy is a highly valued, which makes the region fertile ground for activist short sellers which thrive on information vacuums.

Activist shorting remains a controversial strategy as the research is presented with the clear intent on driving share prices down. However, it’s a highly risky strategy as the strategy is exposed publicly and available for scrutiny, providing both long holders and short sellers with information potentially useful in valuing the firm.

When done properly, it is in the public interest for this research to be published and considered based on the merits of the analysis.

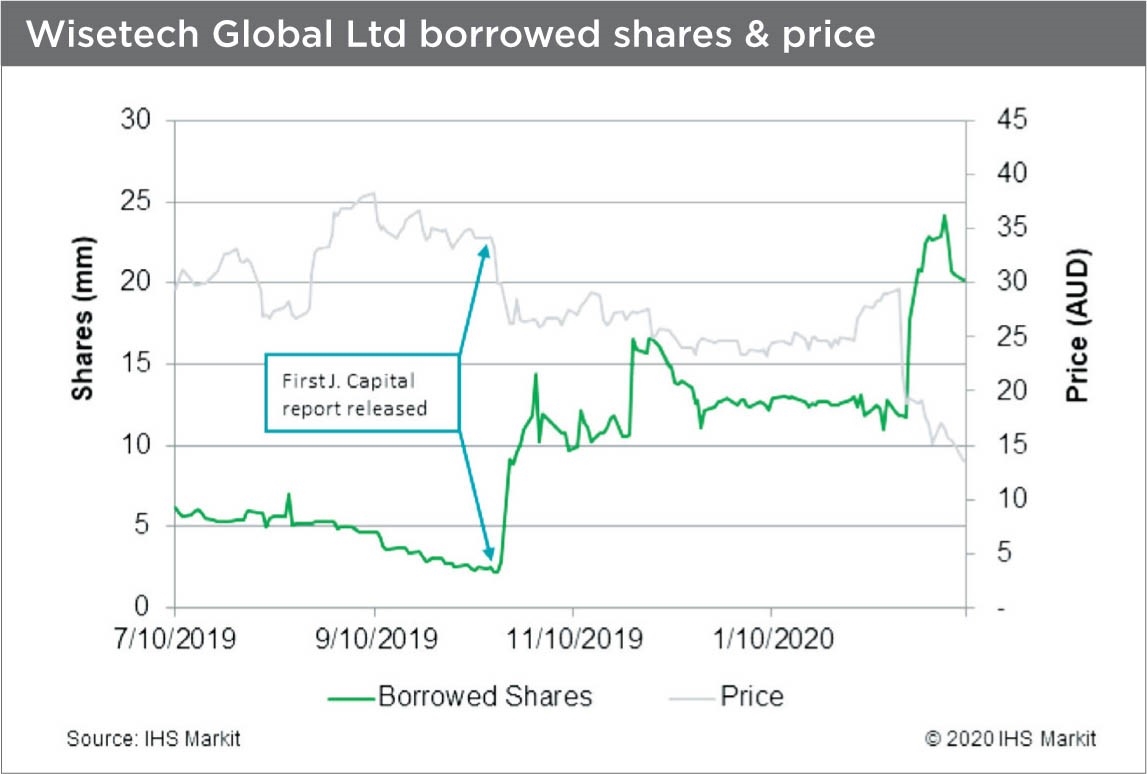

A recent example within APAC was Wisetech Global Ltd (WTC), J Capital Research has released three reports to date, (the first highlighted on chart below). The share price is down -59% since the first report was published. Borrowing of shares was in decline on the eve of the report, though J Capital Research does reveal it was short the shares of WTC at time of publishing.

How do you see 2020 playing out for APAC?

Obviously the current global situation is hard to predict, however, the APAC region has had a headstart dealing with the virus and it’s recent experience dealing with SARS, has resulted in countries such as South Korea leading the world in response to coronavirus. In theory this should place the region in a strong position to rebound, however, the region is still dependent on global demand.

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you