2019 – A Regulatory Red-Letter Year?

By Phil Morgan, Chief Operating Officer at Pirum

Years that end in a “9” have a habit of being eventful. More particularly, they tend to be years of sea change. 1789 was the year of the French Revolution. The Peterloo massacre, a defining moment in British history, took place in 1819. The year 1939 requires no further explanation while 1979 saw the Iranian Revolution and the arrival of Margaret Thatcher. A decade later in 1989 we saw the tearing down of the Berlin Wall. In 2009, central banks had to pull out all the stops to prevent the deepest recession since the second world war turning into a second Great Depression which of course commenced in............1929. With that in-mind it is with some trepidation, that we welcome 2019. It is clear with the Brexit and ongoing Chinese, Russian and US tensions that there is no shortage of potential headline risk out there. Turning attentions closer to our securities finance home, what are the key areas that market participants should be alert to as 2019 unfurls.

Securities Financing Transactions Regulation

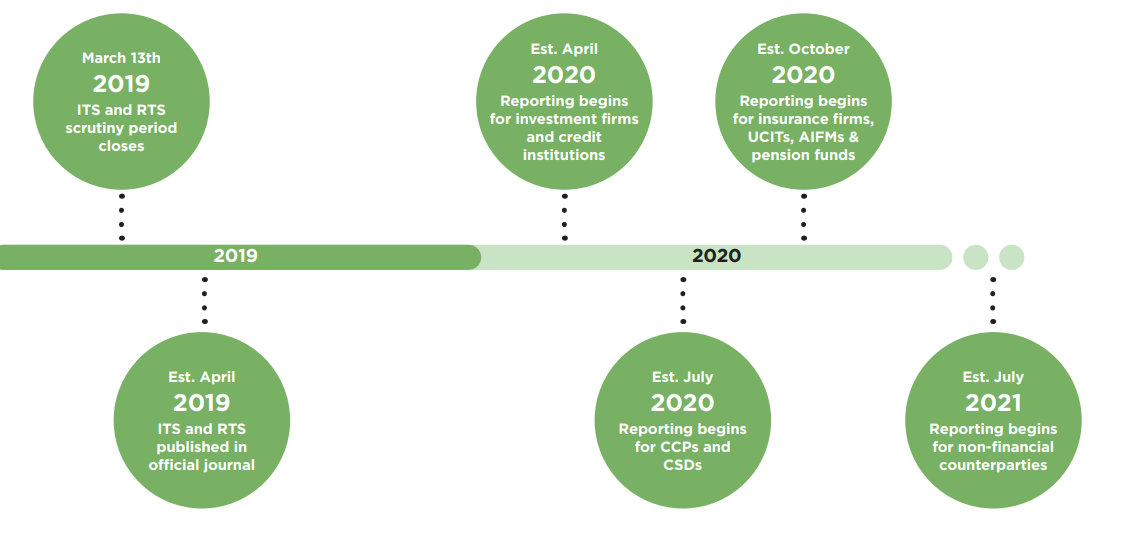

After a protracted period of delay the SFTR level 2 text finally began the adoption process just before Christmas on December 13 2018, bringing into focus a reporting requirement that for many had previously always been just over the horizon. The consensus opinion is that these will most likely be adopted without further changes in April 2019. For participants in the securities finance market this means that April 2020 now becomes a key date in the calendar as the first wave of reporting will commence. The reporting is then rolled out in phases over the subsequent nine months with different types of firms having to report as of different start dates as illustrated below.

Despite the prolonged period between the final draft being published by Esma (March 2017) and the adoption process beginning (December 2018), the details of what has to be reported under SFTR for in-scope participants remains substantially the same. SFTs will need to be reported on a T+1 basis, with collateral to be reported on either T+1 or S+1 at the latest, depending on the method of collateralisation used. The reporting is dual sided with both parties to a transaction reporting their version of the SFT and having to use an agreed Unique Transaction Identifier (UTI) when reporting to a trade repository. The two reported transactions are then reconciled across a number of fields with minimal or no tolerances for differences.

Many of the challenges associated with these requirements have already been widely discussed in industry forums and working groups. At Pirum Systems our preparations for SFTR are well underway. We have been working on the SFTR solution with our partner IHS Markit for nearly two years, and many of these challenges have been discussed with our design partner group, comprised of 40 participants in the SFT market. With the adoption process having begun and the proverbial clock ticking, 2019 will be for many firms the year where SFTR implementation begins in earnest. April 2020 may seem a long way off now. However, unlike objects in your rear-view mirror “it’s actually much closer than it appears”.

Central Securities Depositories Regulation

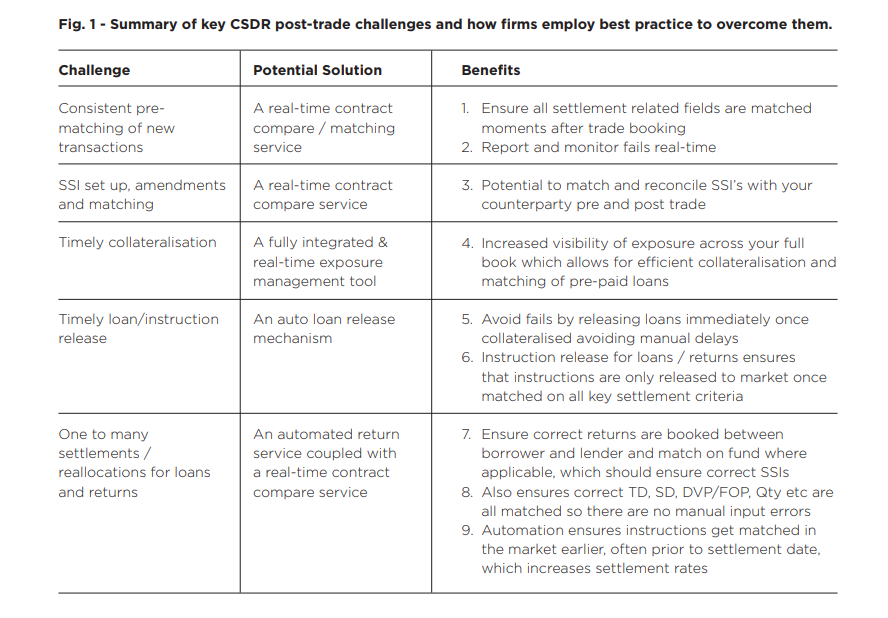

Securities finance participants and the broader market are going to have to adjust to a new and vastly different landscape surrounding settlement discipline. The Central Securities Depositories Regulation (CSDR) will be introduced by Esma in September 2020 and despite its title, CSDR will impact far more than just Central Security Depositories (CSD’s). EU market participants have expressed deep concern that CSDR has the potential to disrupt the established market operating standards. In a nutshell… The CSDR regulation (No 909/2014) is an EU/EEA regulation and not only introduces measures for the authorisation and regulation of EU CSDs but sets out to increase the safety and efficiency of securities settlement infrastructures in the EU. This effectively means that CSDR will impact all transactions, including SFT’s, which are intended to settle on an EU/EEA CSDs.

The CSDR requires CSDs to monitor and facilitate transactions to prevent settlement failure, and where applicable ensure market participants who fail to deliver their securities are subject to both cash penalties and buy-in procedures. This is a huge shift to current market practice, where the buy-in is both discretionary and a relatively rare occurrence within EU securities finance markets. The buy-in will now be mandatory and a regulatory requirement. SFTs that are termed for 30 business days or more and intended to settle on an EU CSD are in scope of the settlement discipline regime. This will apply to any transaction that is due to settle on an EU CSD, regardless of where the trading entity is domiciled.

Interestingly, the failed to party will have the responsibility to initiate the buy-in process, including the appointment of a buy-in-agent. Central counterparty (CCP) cleared trades are the exception, where the CCP will be responsible for initiating this process. The buy-in must be initiated by four business days after intended settlement for liquid shares and seven business days for all other instruments, once initiated the buy-in must be completed within the same prescribed time frame – four business days for liquid and seven business days for all other instruments. Established points of connectivity, that technology vendors and market infrastructures currently provide, will now become essential for those firms looking to comply with the new regulations and avoid the cash penalties and mandatory buy-ins being introduced. Market participants who employ robust technology solutions and processes before September 2020 are more likely to protect themselves against the impacts of CSDR.

Central Clearing

Central clearing has been an item on the agenda, in the SFT market for many years and 2019 looks like it may be the year where this area gains real traction. In Europe, central counterparties have continued to make strides in attracting and on-boarding supply, and CCP usage in North America continued to increase throughout 2018 including a new CCP entrant in the US. Elsewhere, whilst following different operating models, CCP’s in markets such as Brazil, India, Taiwan and Korea are widely utilised for securities lending. The capital benefits from using a CCP are well known, however, what is increasingly being realised is that through an effective STP gateway, clients achieve high levels of automation and enhanced operational efficiencies. This is in addition to achieving risk reduction through standardised processes around collateral management, mark-to-markets, returns, billing, income collection and corporate actions.

Additionally, it seems that market participants are looking to act both proactively and defensively by building CCP infrastructure. Thus, reducing any potential urgency should regulators mandate any form of clearing within securities finance (as happened in the over-the-counter derivatives space). Pirum’s customers currently using the CCP Gateway service, have little or no technical build to undertake before they can begin trading through the supported CCPs. Pirum’s global connectivity hub also allows integration of new CCPs into the gateway service, as markets adopt clearing as a norm.

Uncleared Margin Rules

As phase four (>$750B AANA) and phase five (>$8B AANA) of UMR progresses, thousands of firms will become in-scope during 2019 and 2020. Isda specifically estimates that over 1,100 newly in-scope counterparties (NISCs) and over 9,500 new relationships will become subject to UMR with an estimated 19,000 segregated IM custody accounts requiring setup and testing to be able to meet the requirements.

UMR Requirements

Under UMR, both initial and variation margin are required to be exchanged daily to mitigate the risk of default by a derivatives counterparty. Variation margin is exchanged to cover exposure day-to-day changes in terms of the mark-to-market variations, whilst initial margin is exchanged to cover projected future exposure represented by the maximum loss expected over a 10-day period. Initial margin is mandated to be exchanged on a non-netted basis, whereas variation margin is required to be exchanged on a bilateral, netted basis (by currency); this means that all firms in scope will need to pay and receive margin going forward.

UMR’s Operational Impact:

• Drastic increase in the number of firms becoming in scope and needing to agree margin calls as total inscope firms by phase 5 will increase by ~25x ( ~42 => 1100 firms)

• A dramatic rise in the volume of margin calls that need to be supported

• A potential rise in ongoing issues of processing margin calls as UMR will represent new requirements for many firms or a substantial change for firms that now only agree IA, or IM, on a one-way, bilateral basis

• An escalation of complexity in term of rules and required processes required to adhere to new regulation as UMR is applied at a group level, MTAs are shared between margin calls, and IM must be exchanged daily and held by a third party.

UMR’s Implementation Challenges

Collateral management continues to change as new regulation creates new challenges. Per an Isda/SIFMA July 2018 whitepaper, firm’s challenges start with the need to prepare for compliance. Firms may now require extensive operational and technological builds, have an expected rush of demand on market resources across participants and service providers, and need organisationwide involvement across legal, risk, operations, IT and compliance. The implementation of a solution also presents big challenges. The new landscape demands efficiency where existing collateral management systems and processes are manual, fragmented and inefficient.

Key collateral management challenges include:

• Increased volume and complexity of margin calls driven by daily calculation, zero thresholds and multiple calls against one counterparty means firms need a robust, scalable, STP solution.

• The increased scrutiny on dispute resolution means firms need to track, monitor, match and resolve issue quickly

• The regulatory mandated timeframes mean that firms require margin to be timely settled, reconciled, risk monitored and regulatory reported.

• The requirement to segregate margin means that firms need to not only set-up new third-party custodial arrangements but also connect with these agents to efficiently agree, post and manage 2-way collateralisation.

• New or adapted collateral agreements not only need to be negotiated and put in place, but firms also need to maintain and utilise these schedules in order to ensure that only eligible, correct collateral amounts are exchanged to cover exposure.

• Given the increase in volume, scope and complexity of the margin requirements, firms require efficient processes be put in place in order to best manage collateral. Either to raise or transform, select, mobilise and optimise their margin across a multitude of venues. Pirum will continue to focus on supporting our clients using our exposure and collateral management services in their preparation to support further adoption of regulatory unclear margin rules.

Conclusion

It is clear, that with so many important and seemingly competing operating model headwinds, 2019 is not going to be without its challenges. That said, it does appear that the market is using experience gained through past trials (i.e. Emir and Mifid) and will be ready and better prepared to be able to cope with incoming demands. On a brighter note, however, once we have met and dealt with the demands of 2020 the outlook and landscape beyond does look considerably calmer. But we will see…

Found this useful?

Take a complimentary trial of the FOW Marketing Intelligence Platform – the comprehensive source of news and analysis across the buy- and sell- side.

Gain access to:

- A single source of in-depth news, insight and analysis across Asset Management, Securities Finance, Custody, Fund Services and Derivatives

- Our interactive database, optimized to enable you to summarise data and build graphs outlining market activity

- Exclusive whitepapers, supplements and industry analysis curated and published by Futures & Options World

- Breaking news, daily and weekly alerts on the markets most relevant to you